child tax credit 2022 income limit

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. 2022 EIC Qualification Item No Children With 1 Child With 2 Children With 3 Children.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The credit returns to 2000.

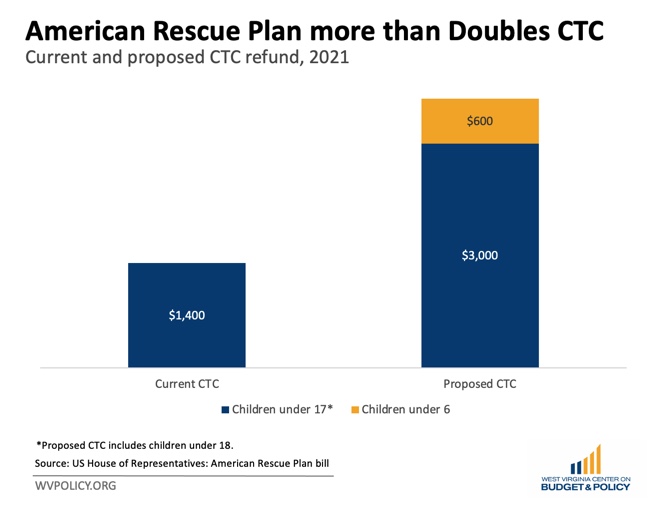

. The maximum credit for taxpayers with no qualifying children is 1502. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Withdrawal threshold rate 41.

Rates per week 2022 to 2023. Number of Children x. Filers could get up to 35 credit on 3000 of child care expenses for one child under age 13 or an incapacitated spouse or parent.

The child tax credit can be worth up to 2000 per child under 17. According to Pennsylvanias official. In 2022 to get the credit the child must be under the age of 17 they cannot be 17.

The CTC is a very valuable benefit for taxpayers with children. Married couples filing a joint return with income of 150000 or less. However there is a child tax.

2022 to 2023 2021 to 2022 2020 to 2021. Child Tax Credit decreased. February 24 2022.

Additionally the enhanced child tax credit allowed for a qualifying taxpayer could be refunded the difference between the amount of taxes they owed and the amount of the. Tax Changes and Key Amounts for the 2022 Tax Year. Families with a single parent also.

Your investment income was 10600 or less during tax year. For instance if you are filing for a single return and your annual income is. The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers.

16 hours agoThe credit was fully refundable even if you did not owe income taxes. How to claim the. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Meanwhile for single heads of households the income limit has been set at 112500USD.

Distributing families eligible credit through. Of the 2000 1500 is refundable. Following are the conditions for claiming EITC on a 2022 filing April 2023 2023 Filing April 2023 tax return.

A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750. Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year. The Child Tax Credit limit is 75000 for.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. If you earn more than. Each child can get.

Earned Income Tax Credit Like the CTC this credit was also expanded under the American Rescue Plan as a way to help low- and moderate-income families with children. The first one applies to the. 2022 Earned Income Tax Credit Amount.

The child tax credit CTC. The child tax credit CTC will return to at 2000 per child in 2022. The Child Tax Credit 2022 is now worth up to 2000 per qualifying child and can be.

1 day ago2022 rules youll use for filing. Taxpayers who have income above these limits may still be able to claim the credit but. This is up from 16480 in 2021-22.

Threshold for those entitled to Child Tax Credit only. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. 1 day agoThe Child Tax Credit in 2022 is a powerful tax tool that can help you save on your taxes.

All eligible applicants should have at least one qualifying child. For tax year 2022 the Child Tax Credit returns to pre-2021 amounts. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

City Of Dayton Ohio On Twitter During Tax Filing Season Income Eligible Dayton Residents Can Take Advantage Of The Earned Income Tax Credit Eitc And The Child Tax Credit Ctc As Ways To Boost

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

The Child Tax Credit Research Analysis Learn More About The Ctc

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Changes To Child Tax Credit Under American Rescue Plan Will Help 400 000 Kids In West Virginia West Virginia Center On Budget Policy

2022 Child Tax Credit What Will You Receive Smartasset

What Is The Child Tax Credit Tax Policy Center

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Low Income Housing Tax Credit Ihda

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Child Tax Credit 2021 Here S How Families Say They Ll Use Basic Income For Kids Cbs News

Future Child Tax Credit Payments Could Come With Work Requirements

What Is The Child Tax Credit And How Much Of It Is Refundable