what happens if i gift more than the annual exclusion

In 2018 the annual exclusion will be 15000 in 2017 it is 14000. The 15000 figure is the amount of the current gift tax exclusion in 2020 meaning that any person who gives away 15000 or less to any one individual in one particular year does not have to report the gift to the IRS and you can give this amount to as many people as you like.

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

If you have been following all the changes in the estate and gift tax exclusion amount over the past several years you probably know that you can now give away during your life or on your death 10000000 adjusted for inflation estate and gift tax free.

/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)

. An annual exclusion gift is a gift that can be included in the gift givers yearly exclusion. The person who makes the gift files the gift tax return if necessary and pays any tax. If someone gives you more than the annual gift tax exclusion amount 15000 in 2018 the giver must file a gift tax return.

In 2019 the annual exclusionary gift is 15000. The applicable credit amount is available to every taxpayer once. Estates that exceed a certain amount are subject to the estate tax before they can be transferred to beneficiaries.

The federal government imposes a tax on gifts. If youre married you and your spouse can each gift up to 15000 to any one recipient. The gifts might not be.

Gifts to your spouse. Gifts to your spouse. The person who makes the gift files the gift tax return if necessary and pays any tax.

How the gift and estate tax. You dont actually owe gift tax until you exceed the lifetime exclusion which is 1206 million in 2022. If you gift more than the exclusion limit to a recipient youll need to file tax forms to disclose those gifts to the IRS.

Contributions to 529 plans Coverdell ESAs and UGMA UTMAs are all treated as gifts subject to annual exclusion amounts. And because annual gifts reduce the. However if your gift exceeds 16000 to any person during the year you have to report it on a gift tax return IRS Form 709.

Spouses splitting gifts must always file Form 709 even when no taxable gift is incurred. If someone gives you more than the annual gift tax exclusion amount 15000 in 2019 the giver must file a gift tax. Annual exclusion gifts are usually cash stocks bonds portions of real estate or forgiving debt on a family loan in an amount that doesnt.

What happens if I gift more than the annual exclusion. Gifts over 15000 are considered taxable gifts and must be reported on an annual gift tax return Form 709. Tuition or medical expenses you pay for someone the educational and medical exclusions.

But 1206 million is such a. You wouldnt have to pay any taxes on that 10000. What happens if I gift more than the annual gift tax exclusion.

If you gift more than the exclusion to a recipient you will need to file tax forms to disclose those gifts to the IRS. The general rule is that any gift is a taxable gift. Using the annual gift tax exclusion ensures that every penny of your 15000 annual gift is excluded from your 117 million lifetime gift and estate tax exemption.

Generally the following gifts are not taxable gifts. This amount is known as the annual exclusion amount which for 2021 is 15000 per beneficiary 2. This result is accomplished by requiring an executor to add to a decedents gross estate on the estate tax.

Every year the IRS sets an amount of money that a gift-giver can give to a recipient free from taxes. The lifetime gift tax exclusion is shared with the estate tax which means the more money you give above the annual gift exclusion the less money you will be able to leave to your heirs tax-free when you die. Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022.

There is an annual 15000 gift tax exclusion also indexed for inflation for assets you give to individuals. That amount is called the annual exclusion. Gifts that are not more than the annual exclusion for the calendar year.

You need to file a gift tax return using IRS Form 709 any year in which you exceed the annual exclusion. If you give away up to but not more than 15000 per person in a calendar year whether in cash or other property of value then you definitely are not required to file a federal tax form known as a Form 709. This 1206 million exclusion means that even if you are technically required to file a Form 709 because you gave away more than 16000 to any one person last year you will owe taxes only if you have given away more than a total of 1206 million in the past.

The annual Gift Tax exclusion is indexed annually which means that you can gift larger amounts in your life without Gift Tax concerns. To the extent that a taxpayer uses it up by making lifetime gifts in excess of the annual exclusion it is not available to reduce the amount of a decedents estate that is subject to the estate tax at death. That still doesnt mean they owe gift tax.

Gifts above the annual gift tax exclusion amount made during the year generally must be reported on Form 709. Unlimited gifts can be made to a spouse without gift tax consequences. If someone gives you more than the annual gift tax exclusion amount 15000 in 2019 the giver must file a gift tax return.

Though you must file you do not have to worry about. You may also have to pay taxes on it. Because you exceeded the annual gift tax exclusion by 10000 you would have to report that with the IRS.

What happens if I gift more than the annual exclusion. You just cannot gift any one recipient more than 15000 within one year. If you give away more than 15000 to any one person in a single year other than.

What happens if I gift more than the annual exclusion. The annual exclusion is a tax benefit taxpayers can use when giving a gift that exceeds the exclusion amount. The person who makes the gift files the gift tax return if necessary and pays any tax.

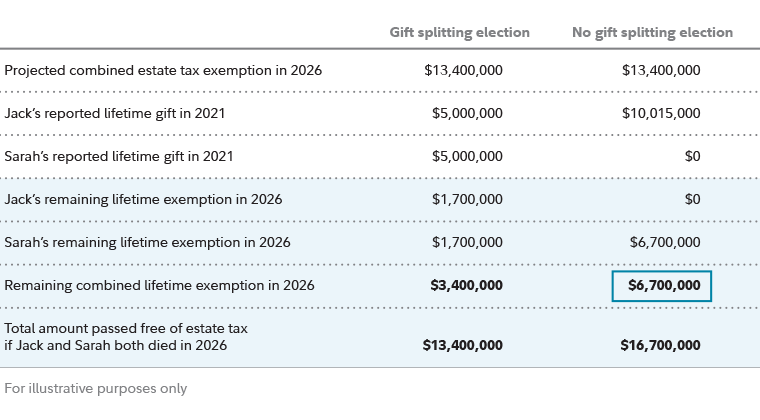

Large gifts transferred during your lifetime may also have tax implications after your death. However there are many exceptions to this rule. Mar 10 2021 7 min read.

That still doesnt mean they owe gift tax. More than that amount you are expected technically to file a federal Form 709. Once you give more than the annual gift tax exclusion you begin to eat into your lifetime gift and estate tax exemption.

The lifetime gift tax exclusion is shared with the estate tax which means the more money you give above the annual gift exclusion the less money you will be able to leave to your heirs tax-free when you die. This is done using Form 709 - United States Gift and Generation-Skipping Transfer Tax Return. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift.

The 117 million lifetime exclusion for tax year 2021 applies to both your gift and estate taxes. What happens if my estate and gift tax exclusion reverts. All that would likely happen is that your lifetime gift tax exclusion the 117 million referenced earlier would be reduced by.

Its separate from the lifetime gift and estate tax exemption. If someone gives you more than the annual gift tax exclusion amount 15000 in 2018 the giver must file a gift tax return.

A Tax On Giving Understanding The Rules

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Annual Gift Tax Exclusion H R Block

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

Estate Planning Strategies For Gift Splitting Fidelity

Reduce The Value Of Your Estate With Annual Exclusion Gifts Blog Video Corporate Gifts Blog

Tips To Help You Figure Out If Your Gift Is Taxable Wheeler Accountants

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Annual Gift Tax Exclusion Explained Pnc Insights

Common Misunderstandings About Gift Taxes Drobny Law Offices Inc

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

How Much Money Can You Gift Tax Free The Motley Fool

The Lifetime Gift Tax Exemption Everything You Need To Know

California Gift Taxes Explained Snyder Law

Gift Tax What Is It How Does It Work Personal Capital

Irs Announces Higher 2019 Estate And Gift Tax Limits

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

Gift Tax And Other Exclusions Increases For 2022 Henry Horne